It provides a lump sum payment subject to conditions if the life insured dies or is diagnosed with a terminal illness where death is likely to occur within 12 months 10life insurance is a way of protecting the financial future of your loved ones if you were no longer around to provide for them. Indeed with increasing pressure on government budgets and life expectancies extending life insurance must play a greater role in our society.

Life insurance plays a vital role in australias social construct and in providing financial protection to those policyholders in need it truly has a noble purpose.

Term life insurance australia. Life insurance is about your loved ones and ensuring theyll be looked after financiallywithout a proper or adequate term life insurance policy you risk your dependents being left in financial disarray. Life insurance for families. Heres an overview of how it works.

Aia australia aia has today announced the execution of its joint cooperation agreement with the commonwealth bank of australia cba an alternative completion structure for the purchase of cbas life insurance business known as comminsure life the colonial mutual life assurance society limited cmla and certain affiliated companies. Life insurance is not about you. Smart term life insurance from hcf keeps you covered with the security of fixed payments over a limited time period.

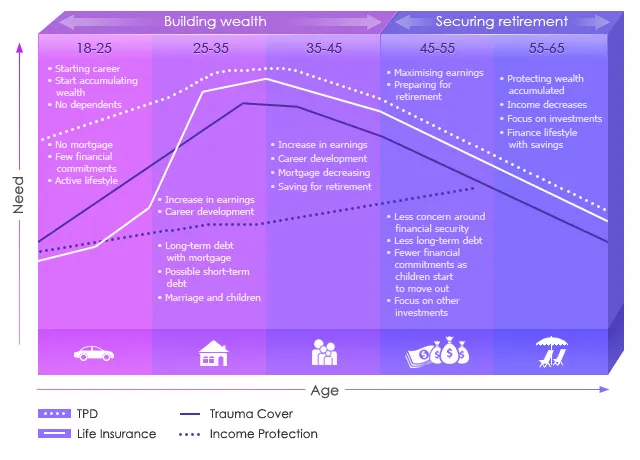

Most australians take out term life policies when they first have kids and its important that they seek the right amount of cover. Term life insurance provides cover for your family and anyone else that is financially dependent on you in the event that you pass away or are diagnosed. What is term life insurance in australia.

A life insurance policy pays out a benefit to your family if the worst were to happen. Life cover is also known as term life insurance or death cover. Term life insurance is the type of life insurance youre most likely to come across in australia.

There are various factors to consider before choosing a life insurer including their policy features and benefits and the. Term life insurance is the type of life insurance youre most likely to come across in australia. It provides a lump sum payment subject to conditions in the event the life insured dies or is diagnosed with a terminal illness where death is likely to occur within 12 months 10.

The best life insurance company is the one that suits your requirements and fits your budget while providing you peace of mind that your family will be protected if you pass away or get diagnosed with a terminal illness. How to choose the best life insurance in australia. Life insurance is also known as term life insurance or death cover.

Metropolitan Life Insurance Company 200 Park Avenue New York Ny

Metropolitan Life Insurance Company 200 Park Avenue New York Ny

Piramal Healthcare In Talks To Buy Out Enam Financial From Ing

Piramal Healthcare In Talks To Buy Out Enam Financial From Ing

When Should I Check My Life Insurance Cover Metlife Australia

When Should I Check My Life Insurance Cover Metlife Australia

Super Life Insurance Vs Standalone Policies Life Insurance Mozo

Super Life Insurance Vs Standalone Policies Life Insurance Mozo

Guide To Child Cover Life Insurance Comparison

Guide To Child Cover Life Insurance Comparison

2019 Insurance Industry Outlook Deloitte

2019 Insurance Industry Outlook Deloitte

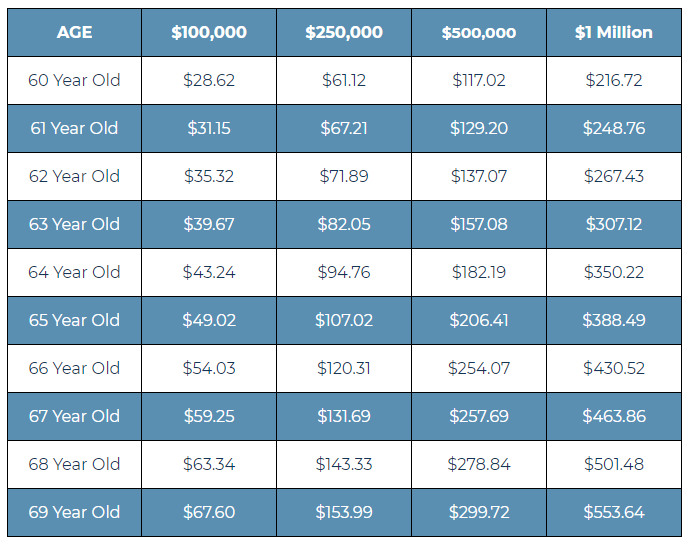

What S The Cost Of Term Life Insurance 2020 Monthly Rates

What S The Cost Of Term Life Insurance 2020 Monthly Rates

Qbe Life Australia Limited Life S Insurance

Qbe Life Australia Limited Life S Insurance

Original Life Insurance Quotes Online Australia Squidhomebiz

Original Life Insurance Quotes Online Australia Squidhomebiz

Types Of Life Insurance Policy In India

Types Of Life Insurance Policy In India

Get Term Life Insurance Quotes Online

Get Term Life Insurance Quotes Online

Cheap Travel Insurance Quotes Australia Life Insurance Quotes

Cheap Travel Insurance Quotes Australia Life Insurance Quotes

2019 Insurance Industry Outlook Deloitte

2019 Insurance Industry Outlook Deloitte

Comprehensive Life Insurance Quotes Australia By Omnium Com Au

Comprehensive Life Insurance Quotes Australia By Omnium Com Au

Life Insurance Comparison Australia Quotes From 10 Brands Finder

Life Insurance Comparison Australia Quotes From 10 Brands Finder

0 komentar

Posting Komentar